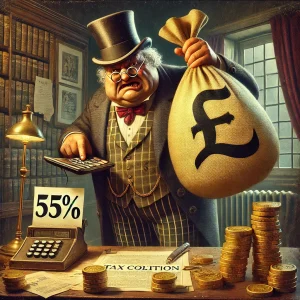

There’s an old Chinese proverb: “One moment of patience may ward off great disaster, but one moment of impatience may ruin a whole life.” Withdrawing your UK pension early through QROPS (before age 55) may seem appealing at first but can lead to devastating consequences. Any withdrawals made before age 55 are classified as “unauthorized payments” by Her Majesty’s Revenue and Customs (HMRC) and are subject to a 55% tax on QROPS transfers, along with potential additional penalties. While it might sound like a shortcut to access your savings early, the reality is that impatience could cost you more than half your pension.

HMRC Guidelines and the 55% Tax on QROPS Transfers

The HMRC website lists various pension schemes available for QROPS transfers. However, it explicitly states that it is the investor’s responsibility to ensure the new scheme complies with HMRC requirements.

If a new scheme fails to meet HMRC QROPS standards, a 40% tax is automatically applied to the transfer. This increases to a 55% penalty on QROPS transfers if you attempt to withdraw your pension before age 55.

For those who have lived and worked in the UK, accumulated a pension, and now reside in India, the temptation to withdraw your pension early may arise. However, doing so disqualifies the scheme as a QROPS, triggering substantial penalties and the 55% tax rate on QROPS unauthorized transfers.

Hidden Risks of Early QROPS Withdrawals

Many banks and insurance companies may offer options to withdraw your UK pension early through QROPS. What they often fail to mention is the 55% tax on QROPS transfers. This significant penalty could wipe out over half your life savings, making the seemingly lucrative offer a financial trap.

It’s crucial to work with a knowledgeable financial advisor who understands HMRC regulations and can help you avoid the pitfalls of unauthorized QROPS transfers. Ensuring compliance with QROPS rules protects your pension and saves you from unnecessary tax liabilities.

The Benefits of a Legitimate Pension Transfer

On a brighter note, transferring your UK pension to India through a compliant QROPS scheme is tax-free and can offer significant benefits. Not only do you avoid the 55% inheritance tax, but you also gain access to India’s rapidly growing economy, which is attracting global investors.

Instead of leaving your pension stagnant in the UK, where the economic outlook remains uncertain, you can invest it in Indian equities or other high-growth opportunities. This approach ensures your pension grows while you benefit from a more favorable tax environment.

Final Thoughts on Avoiding the 55% QROPS Tax

Patience and proper planning are essential when considering a UK pension transfer to India. Avoid the costly mistake of unauthorized withdrawals, which result in the 55% tax on QROPS transfers and potentially wipe out your savings.

By transferring your pension to India through legitimate and compliant QROPS schemes, you not only secure your financial future but also tap into the immense growth potential of one of the world’s fastest-growing economies. Choose wisely, plan carefully, and protect your pension from unnecessary taxes and penalties.